I am pleased to announce that investr, my very first R package, has now been on CRAN for four years! investr, which is short for inverse estimation in R and has nothing to do with investing, contains functions that facilitate inverse estimation (e.g., statistical calibration) in linear, generalized linear, nonlinear, and (linear) mixed-effects models. A generic function, plotFit, is also provided for plotting fitted regression models with or without confidence/prediction bands that may be of use to the general user.

Inverse estimation, also referred to as the calibration problem, is a classical and well-known problem in regression. In simple terms, it involves the use of an observed value of the response (or specified value of the mean response) to make inference on the corresponding unknown value of an explanatory variable.

A detailed introduction to investr was been published in The R Journal: “investr: An R Package for Inverse Estimation”, http://journal.r-project.org/archive/2014-1/greenwell-kabban.pdf. You can track development at https://github.com/bgreenwell/investr. To report bugs or issues, contact the main author directly or submit them to https://github.com/bgreenwell/investr/issues.

As of right now, investr supports (univariate) inverse estimation with objects of class:

"lm"- linear models (multiple predictor variables allowed)"glm"- generalized linear models (multiple predictor variables allowed)"nls"- nonlinear least-squares models"lme"- linear mixed-effects models (fit using thenlmepackage)

Installation

The package is currently listed on CRAN and can easily be installed:

# Install from CRAN

install.packages("investr", dep = TRUE)The package is also part of the ChemPhys task view, a collection of R packages useful for analyzing data from chemistry and physics experiments. These packages can all be installed at once (including investr) using the ctv package (Zeileis, 2005):

# Install the ChemPhys task view

install.packages("ctv")

ctv::install.views("ChemPhys")Examples

Dobson’s Beetle Data

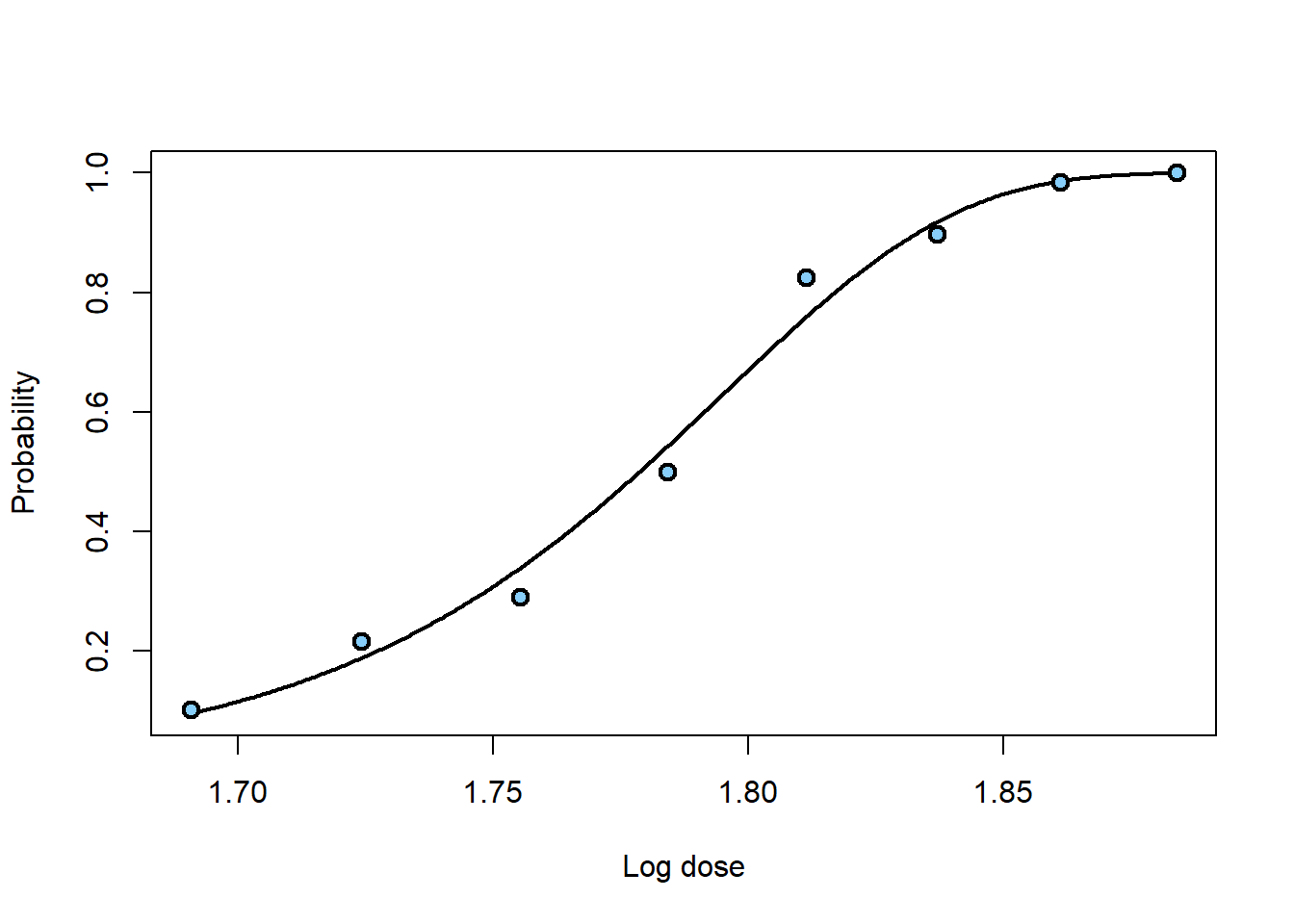

In binomial regression, the estimated lethal dose corresponding to a specific probability p of death is often referred to as LDp. invest obtains an estimate of LDp by inverting the fitted mean response on the link scale. Similarly, a confidence interval for LDp can be obtained by inverting a confidence interval for the mean response on the link scale.

# Load required packages

library(investr)## Warning: package 'investr' was built under R version 3.4.1# Binomial regression

beetle.glm <- glm(cbind(y, n-y) ~ ldose, data = beetle,

family = binomial(link = "cloglog"))

plotFit(beetle.glm, lwd.fit = 2, cex = 1.2, pch = 21, bg = "lightskyblue",

lwd = 2, xlab = "Log dose", ylab = "Probability")

# Median lethal dose

invest(beetle.glm, y0 = 0.5) ## estimate lower upper

## 1.778753 1.770211 1.786166# 90% lethal dose

invest(beetle.glm, y0 = 0.9) ## estimate lower upper

## 1.833221 1.825117 1.843062# 99% lethal dose

invest(beetle.glm, y0 = 0.99) ## estimate lower upper

## 1.864669 1.853607 1.879126To obtain an estimate of the standard error, we can use the Wald method:

invest(beetle.glm, y0 = 0.5, interval = "Wald")## estimate lower upper se

## 1.7787530 1.7709004 1.7866057 0.0040065# The MASS package function dose.p can be used too

MASS::dose.p(beetle.glm, p = 0.5)## Dose SE

## p = 0.5: 1.778753 0.00400654Including a factor variable

Multiple predictor variables are allowed for objects of class lm and glm. For instance, the example from ?MASS::dose.p can be re-created as follows:

# Load required packages

library(MASS)

# Data

ldose <- rep(0:5, 2)

numdead <- c(1, 4, 9, 13, 18, 20, 0, 2, 6, 10, 12, 16)

sex <- factor(rep(c("M", "F"), c(6, 6)))

SF <- cbind(numdead, numalive = 20 - numdead)

budworm <- data.frame(ldose, numdead, sex, SF)

# Logistic regression

budworm.glm <- glm(SF ~ sex + ldose - 1, family = binomial, data = budworm)

# Using dose.p function from package MASS

dose.p(budworm.glm, cf = c(1, 3), p = 1/4)## Dose SE

## p = 0.25: 2.231265 0.2499089# Using invest function from package investr

invest(budworm.glm, y0 = 1/4,

interval = "Wald",

x0.name = "ldose",

newdata = data.frame(sex = "F"))## estimate lower upper se

## 2.2312647 1.7414522 2.7210771 0.2499089Bioassay on Nasturtium

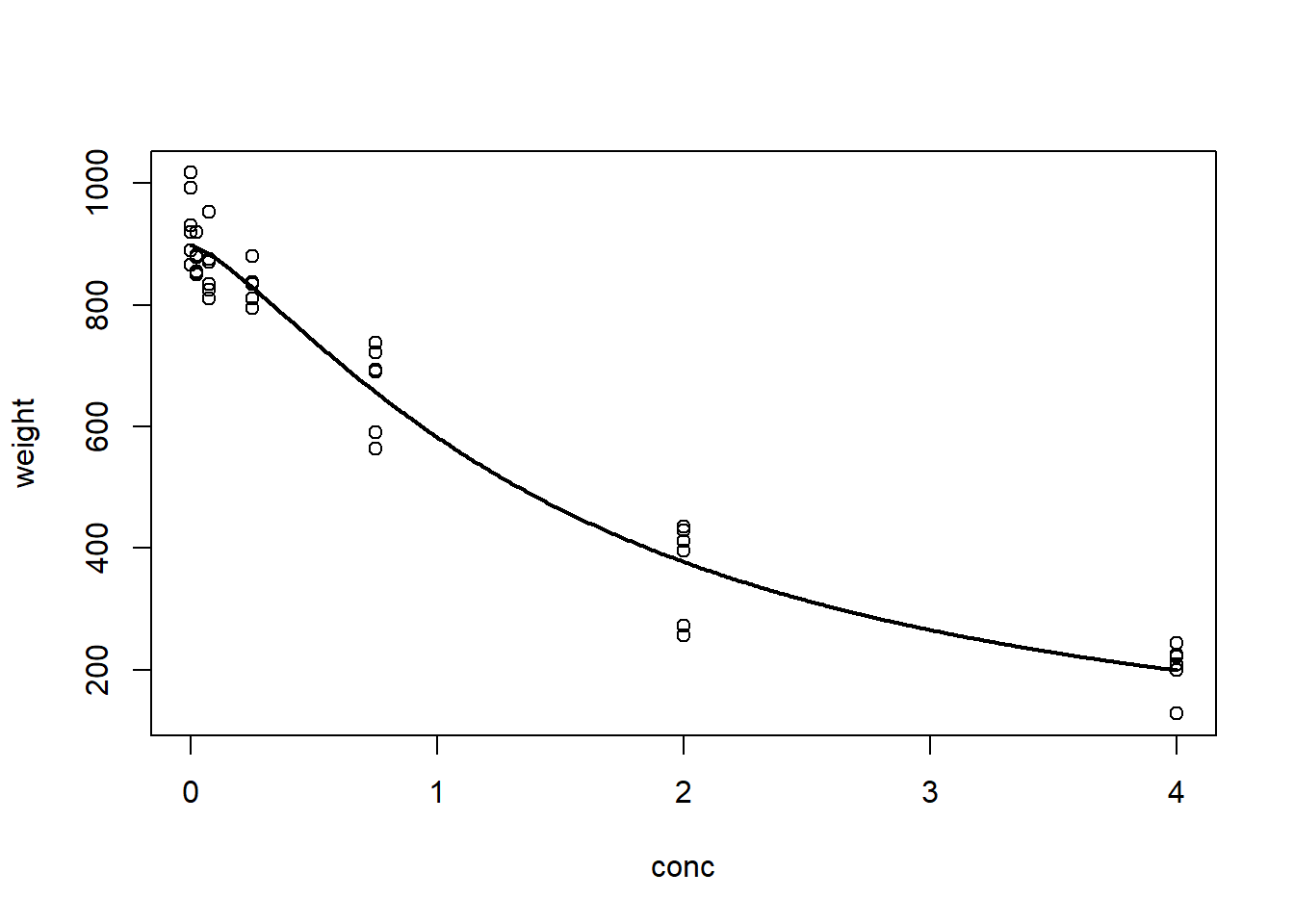

The data here contain the actual concentrations of an agrochemical present in soil samples versus the weight of the plant after three weeks of growth. These data are stored in the data frame nasturtium and are loaded with the package. A simple log-logistic model describes the data well:

# Log-logistic model for the nasturtium data

nas.nls <- nls(weight ~ theta1/(1 + exp(theta2 + theta3 * log(conc))),

start = list(theta1 = 1000, theta2 = -1, theta3 = 1),

data = nasturtium)

# Plot the fitted model

plotFit(nas.nls, lwd.fit = 2)

Three new replicates of the response (309, 296, 419) at an unknown concentration of interest (\(x_0\)) are measured. It is desired to estimate \(x_0\).

# Inversion method

invest(nas.nls, y0 = c(309, 296, 419), interval = "inversion")## estimate lower upper

## 2.263854 1.772244 2.969355# Wald method

invest(nas.nls, y0 = c(309, 296, 419), interval = "Wald") ## estimate lower upper se

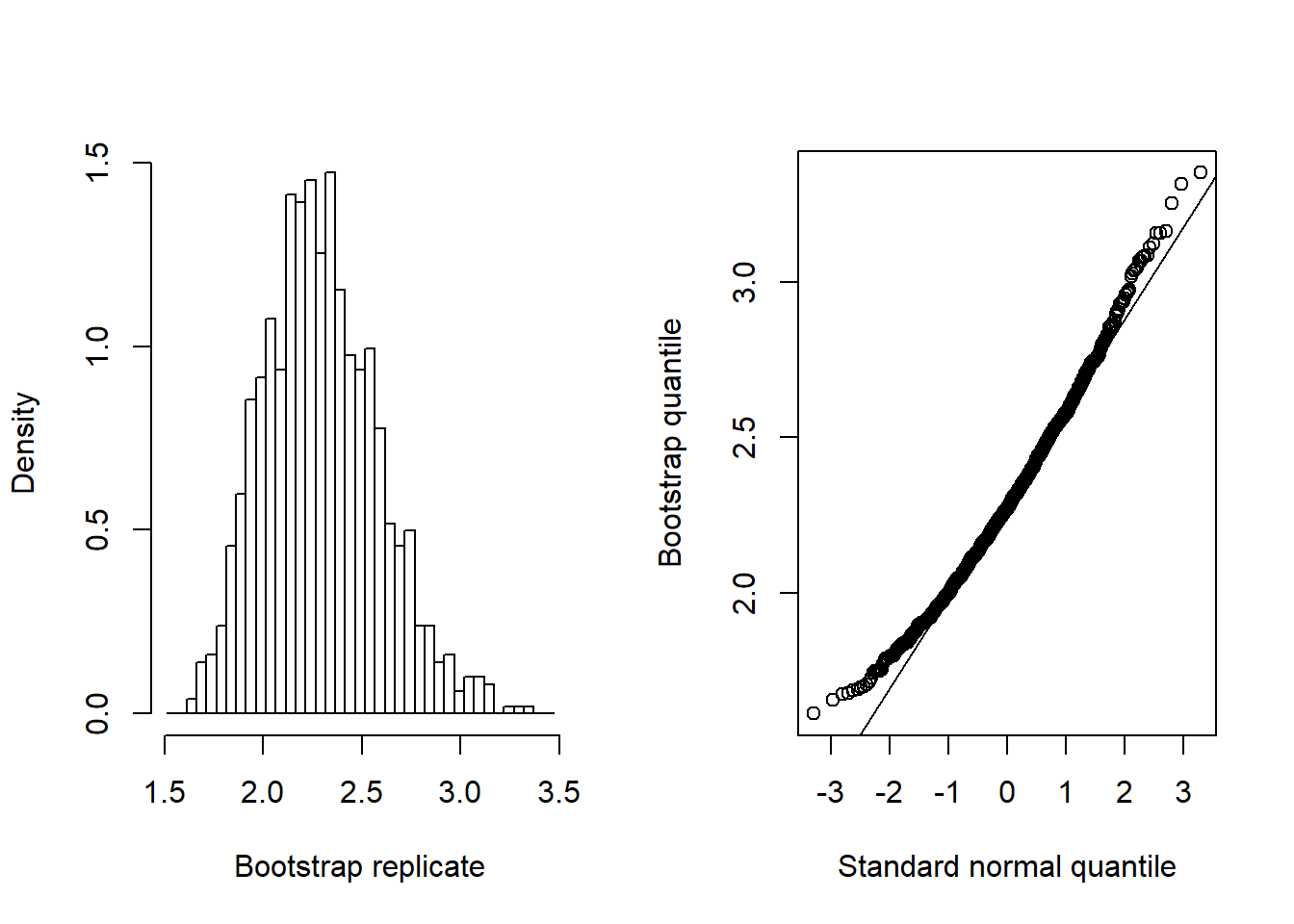

## 2.2638535 1.6888856 2.8388214 0.2847023The intervals both rely on large sample results and normality. In practice, the bootstrap may be more reliable:

# Bootstrap calibration intervals (may take a few seconds)

boo <- invest(nas.nls, y0 = c(309, 296, 419), interval = "percentile",

nsim = 999, seed = 101)

boo # print bootstrap summary## estimate lower upper se bias

## 2.2638535 1.8005534 2.9335622 0.2909187 0.0320422plot(boo) # plot results